Value is the amount of commodity; money, etc. consider equivalent for something else, material monetary worth, desirability, utility, qualities on which it depends. Value is the actual worth of a particular object Value for which a willing seller will part with the land in favour of willing buyer, Value is an estimate of the cost of a commodity on certain date depending on its utility, scarcity, transferability and marketability (www.valuerplus.com). According to Mulyankan Consultants Ltd (n.d.), the term value refers to an estimated worth (of an object, item, utility or whatever) expressed in prevailing monetary terms by the expert, experienced and prudent Valuer, who is not directly or indirectly interested in, or connected to that specific asset which is being valued for a particular purpose. According to Occupational & Professional Licensing Administration (2011), a property has many different ‘values’; these include:

- Investment value – This is the value that is generally used by investors. It is frequently determined either by calculating the net operating income and applying a capitalisation rate to it or from cash flow by determining the return on investment.

- Assessed value – This is the value used by government tax assessment offices. Since it is frequently

- Determine d using sophisticated mathematical models that are applied to many similar types of properties over a geographic area, it can be less accurate and produce results that are higher or lower than other types of ‘values’.

- Market value – This is the value that is agreed to between a buyer and seller. It represents the ‘meeting of the minds’.

- Depreciated value – This is used for income tax purposes and affects a property’s tax basis.

- List price – This is only the price that the owner has offered to sell a property for.

The notion of the property value is central to the theory and practice of estate management. The main aim or purpose of estate management is to secure maximum returns from real property. This return may be in many forms and this reflects what is known as productivity of real property. The measure of the benefits and services derivable from owing and using a property is known as its value. It is the same thing as the quantification (in monetary terms) of the utility of property the worth of its productivity. Therefore property value is the yardstick, which measures both the degree of scarcity and the utility of real property especially when it is compared with other competing alternatives (investment opportunities).

For income producing real properties, productivity is measured by its income generating capacity. The productivity of some classes of non-income property (e.g. owner occupied premises) can be estimated by means of comparison with the income producing capabilities of similar property types, which are let out. Alternatively, the productivity of property types which are not usually let but which sell frequently will be based on comparative sale prices of similar properties. After all, it is agreed that a sale price is the capitalization of annual productivity, that is, the lumping together at a particular point in time of a set of future periodic income expected from an asset over a given period of time. However, in a situation where property produces no income and rarely sold (that is there are no similar and comparable property types of give rental or sale’s evidence), productivity can be indicated by the cost of either producing a replicate property or replacing the property in question.

Factors affecting property value: Appraisal Institute (2001) in Lorenz & Lützkendorf (2008), Gaddy and Hart (2003) stated that property value is affected by the interaction of four basic forces. These four basic forces were listed by them as follows:

- Physical forces, including man-made and environmental externalities. Examples are: climate; topography and characteristics of the land; natural barriers to future development such as rivers, mountains, lakes, and oceans; primary transportation systems and public service amenities; and the nature and desirability of the immediate area surrounding a property.

- Economic forces, including the fundamental relationship between supply and demand and the economic ability of the population to satisfy its wants, needs and demands through its purchasing power. Examples are availability of employment; wage and salary levels; the economic base of the region and the community; cost and availability of mortgage credit; the existing stock of vacant properties; new developments under construction; rental and sale price patterns of existing properties; and construction costs.

- Political and governmental forces, which can overshadow the market forces of supply and demand. Examples are government controls over money and credit; local zoning, building codes and regulations, health and safety codes; rent controls and fiscal policy; environmental legislation; and restrictions on forms of ownership.

- Social forces, including not only population changes and characteristics but also the entire spectrum of human activity. Examples are: population age and gender; birth rates and death rates; attitudes towards marriage and family size; current lifestyle, lifestyle changes and options; attitudes towards education, law and order as well as other moral attitudes.

Reference

Occupational & Professional Licensing Administration (2011). Study guide for Property Managers examination. Department of Consumer and Regulatory Affairs, District of Columbia.

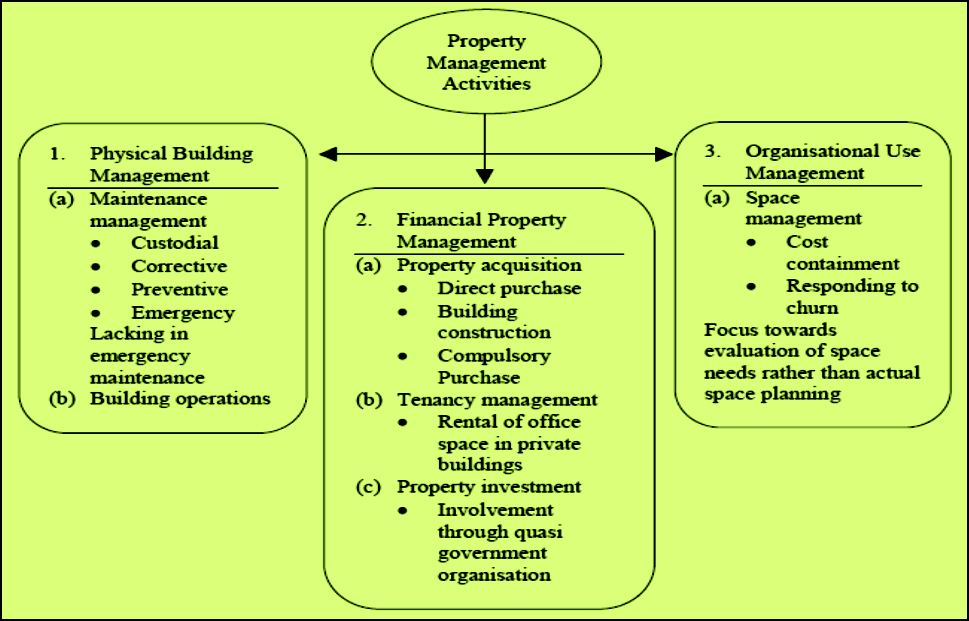

PM Activities (Isa, no date, in Olusegun, 2015)

Property management may involve seeking out tenants to occupy the space, collecting monthly rental payment, maintaining the property, and upkeep of the grounds. Thus, property management is the administration of residential, commercial and industrial real estate including apartments, detached houses, condominium units and shopping centers. Furthermore, property management entails the management of personal property, equipment, tooling and physical capital assets that are acquired and used to build, repair and maintain end item deliverables. Property management involves the processes, systems and manpower required to manage the life cycle of all acquired property as defined above including acquisition, control, accountability, responsibility, maintenance, utilisation and disposition.

Principles of ‘Management’ for Property Management Companies

Most of the property management companies often follow specific property management principles to enable them deliver their management services for those properties that need them within the market. Outlined below are some of the principles that are usually employed by property management companies: · Principle of division of work: Most of these companies have divided the operations into departments to enable them work more efficiently. Through the departments, they have delegated work to ensure that all employees contribute positively to the operations within the company thus enhancing their job their performance. · Principle of authority and responsibility: Most of these companies often understand the importance of principle of authority and responsibility when managing their operations in the real estate market. · Discipline in their management roles: The principle of discipline often plays an important role in the success of every company whenever they operating in the real estate industry. Discipline the mission and vision of the company always plays an important role whenever they are operating within the market. Most of these companies have always ensured that they achieve their set goals. · The degree of centralisation: The amount of company power that is wielded with central management often depends on the size of the company. Centralisation often implies concentration of authority of decision making at the top the company’s management. Sharing of the authority with the lower levels is known as decentralisation of real estate companies. The companies often work hard to achieve that proper balance. · Subordination of the individual interest: The management of these companies must always put aside their personal considerations by putting the company objectives first. Hence, the interests of goals of company must always prevail over the individuals interests when operating to allow the company to grow in the real estate industry. |

There are two major branches of property management – logistical and physical.

- Logistics of property management: A key factor in the logistics of property management is financial reporting. Financial reporting must be timely and accurate to be effective. Regular and comprehensive reporting establishes continuity and reduces the number of lines of communication, thus maximising time and minimising confusion. Such reports should always adhere to GAAP (General Accepted Accounting Principles), though employing a higher set of standards for quality assurance is also ideal. Specific reports, such as cash to budget variances, cash flow and income statements, balance sheets, and complete transactional accounting registers, are fundamental and essential to the property management process. In addition to financial reporting, up-to-date property management software is an important part of logistics. It enables customized reporting for each type of property managed. Investing in infrastructure is critical to managing a diverse portfolio. The more quickly a property management system can identify problems and produce solutions, the more successful a project can be. Further logistical involvement is necessary in developing bid specifications, securing competitive bids, and coordinating with contractors, vendors and suppliers.

- Physical aspect of property management: Beyond the logistical or back-end component of successful property management is the physical component. Preserving, maintaining, protecting and enhancing the physical and financial aspects of real estate holdings is of paramount importance. Without corresponding efforts in logistical and physical property management, neither can achieve complete success. This includes emergency management as well as regular visitations and inspections of the property. Comprehensive inspections deliver far-reaching results, and should include lobbies, stairwells, landscaping, recreation facilities, walks and driveways, parking lots, and other physical aspects of the real estate.

The object of property management

Property management has to do with maintaining both the physical and economic life of the property, so that it will be put to a reasonable level of good use and optimum, envisaged return. In the management of real estate assets, there are a lot of derivable outcomes, which could be the collection of periodic rental income at a minimal expense, to maintain the valve of the property by spending wisely on maintenance, to secure the co-operation of tenants and/or occupiers in order to avoid neglect and voluntary wastes, etc.

Excellent property management would entail:

- Putting the property in sound physical footing through proper orchestrated maintenance and upkeep of the physical property.

- Putting the property in sound economic footing through ensuring optimum returns from the property investment.

- Taking away, as much as possible, inherent management problems from the property owner who may have other life endeavours, which may be engaging his/her attention; or who may not be very knowledgeable in the different facets of property management activities.

- Maintaining good tenant and public relationship.

Some of the basic principles that underlie all good property management solutions:

- Effective, responsive and customised service.

- Strength, generated from team effort and training.

- Creativity and understanding of management principles.

- Goals to enhance the value and aesthetics of a property.

- Constant re-evaluation of procedures to ensure superior levels of quality.

Property Management activities

As stated in the Business Dictionary (2000), PM is the operation of property as a business, which necessitates the performance of the following two main tasks; namely: accounting and reporting, leasing, maintenance and repairs, paying taxes, provision of utilities and insurance, remodelling, rent setting and collection; and Property portfolio management tasks including acquisition and disposition, development and rehabilitation feasibility, financing and income tax accounting. PM focuses on the physical building management, financial property management and organisational use management.

The function of property management as performed by professional Property Managers on behalf of building owners include:

- Collection of rents for property owners: This is an important assignment (not necessarily the only function), for without rent to meet mortgage interest, repairs and maintenance; there is no point wasting one’s time as Property Manager.

- Tenant’s selection: There should be an adequate and careful tenant selection programme to avoid the problem of default in the periodic rent payment.

- Control and supervision of building repairs and maintenance including ordering, measuring of works through proper and effective maintenance system. In the context of building maintenance, the function of Property Manager is to maintain the building to an appropriate and acceptable standard at reasonable cost and with the minimum of inconvenience to the occupiers.

- Keeping and rendering of proper records such as service charge accounts, rent accounts, work order forms, etc.

- Budgeting records: the Property Manager prepares the budget, cash flow and cost control to deal effectively with income and expenditure issues.

- Appointment of bills: The appointment of electricity bill, water bill, tenement rate to the building occupiers based on their respective consuming proportions and to ensure prompt payment of rates and other taxes by such occupiers.

Other property management functions are:

- Periodic rent reviews in tandem with economic realities, and in line with lease terms.

- Arbitration services

- Attending to matters requiring consent of the property owner

- Negotiation of leases of vacant accommodation

- Liaising with other adjoining property owners on issues of mutual interest to the adjoining owner and his client.

- Routine inspection.

- Fixing of service charge and management of service charge account.

- Planning, development or redevelopment, as the situation may demand.

- Security of premises

- Documentation of all transaction carried out on a property.

- Ensuring that tenants pay their rates and taxes regularly.

- Preparation of schedule of dilapidation as at when necessary and adequately advise his client on same.

- Control and supervision of maintenance works.

- Giving of advice to client(s) or tenants on ensuring peaceable occupation etc.

- Ensuring that the surroundings of the property is regularly cleared of weeds, refuse and that the common areas are routinely swept and dusted.

In conclusion, the property manager’s function can be summed up as that of trying to consciously increase returns (through effective property management portfolio in the areas of, property expansion or outright redevelopment, etc.), and trying to be economically prudent, and maintaining high returns through ‘highest and best use’ of the property being maintained.

Reasons for Hiring a Property Manager

Managing a property often involves a variety of administrative tasks, including handling property maintenance, supervising building repairs and ensuring outgoing expenses are paid. Owners who desire to rent their properties to tenants may use the services of a property management company. These types of companies can provide services such as:

- Rent collection: A professional property management company have systems and strategies to improve rent collection and on-time rent payments. This ensures consistent rent collection. Quick and consistent rent collection is absolutely critical in this real estate market where good cash flow can mean the difference between success and failure as a real estate investor.

- Local knowledge of rental rates: Property Management Company have extensive local knowledge of rents and the ability to determine the highest rental rate possible for your property. With the internet and the ability to do large scale searches for rental properties, potential tenants know if your property is overpriced. Overpriced properties sit empty while other properties get rented. Knowledge of rental rates is a key factor to fast rentals and quick cash flow.

- Tenant screening: A Property Management Company requires a detailed written application from each adult with photo identification. Additionally, PM’s will run criminal, social security and public notice (bankruptcy or judgments) searches to determine if the application is accurate. Property Management Company will also call past and present employers, landlords and other references. Property Management Company have set requirements and standards for accepting or declining an applicant and thereby ensuring you comply with fair housing rules and other local and state regulations.

- Marketing expertise: Property Management Company has many years of experience in how to best market properties so they are rented in the quickest time possible. Property Management Company use both offline and online marketing to maximise property exposure and find qualified tenants quicker. Property Management Companies utilises different techniques to rent a property quickly, which reduces the carrying cost of a vacant property.

- Property law and regulations: Property Management Company has extensive and up-to-date knowledge of property laws and regulations and will assist in making sure compliance with the local, state and federal rules and regulations. These rules and regulations include complying with rent control where applicable, environmental management related laws, financial regulations, etcetera. Avoiding one law suit will more than pay for any Property Management Company fees many times over.

- Tested and reliable professionals: Property management company’s will already have vetted numerous vendors, suppliers and contractors to make sure they provided good quality work at reasonable prices. Failure to properly vet these professionals can be a costly mistake. Many property owners overlook this function because they do not know how to do it or because it is a time consuming and laborious process.

- Inspection reports: Property Management Company performs property inspections before, during and after a tenancy. Additionally, most PM’s will perform routine property inspections at least every 180 days. Property Management Company usually prepares frequent written inspection reports for every property in the company’s portfolio. Faults in property that are found quickly can be resolved before they become expensive items of disrepair.

- Financial records and security deposit escrows: Property Management Company will provide detailed income and expenses reports as well as cash statements every month saving you the bookkeeping headache. Additionally, Property Management Company will also manage security deposit escrow funds and make ensure compliance with local and state regulations. Property Management Company will provide end-of-year tax reports for the property owner’s accountant or financial advisor.

- Emergency calls and shield from tenants: A property management company will shield property owners from emergency maintenance calls and tenant headaches.