STEPS TO EFFECTIVE SUCCESSION PLANNING: Ensuring Leadership Continuity in Real Estate Firms

By

KUYE OLUSEGUN (2012)

Dip (Property Law), HND, MSc (Estate Mgt.), MSc (Housing Devt & Mgt), ANIVS, RSV

ABSTRACT

Succession planning involves transferring ownership and control of a business to new management; it is a systematic, proactive human resources approach to ensure leadership continuity, developing potential successors in ways that best fit their strengths, identifying the best candidates for categories of positions and concentrating resources on the talent development process in order to avoid declines in production or disruptions to business flow when the business owner/founder retires or dies. In Nigeria, many professional estate firms have had to close down because there is no credible and competent successor to carry on the business activities after the business owner retires or dies; this should not have been so. The preparation to concede ownership of a business can be tough for owner-managers, but getting it right is crucial if the business is to remain operational and successful. This is the focus of this paper. Key issues elaborately discussed include roadmap to effective succession planning in professional service firms, choosing a business successor and succession planning best practices among others.

1.0 INTRODUCTION

Succession is the assumption of a position or title, the right to take up a position or title, or the order in which a position or title is taken up. According to Webster Dictionary, succession is the act of succeeding or coming after another in order or sequence or to an office, estate, throne, etc. So, while succession is the “act” of replacing someone in the business, the actual replacement can, and has been done with varying level of success. Planning is a system for achieving an objective; a method of doing something that is worked out in advance. Planning is to work out how to do something; or to work out in advance how something is to be done or organised.

Succession planning is a means of identifying critical management positions (Carter, 1986); a process for identifying and developing potential future leaders or successors, as well as individuals to fill other business-critical positions, either in the short or the long-term (CIPD, 2012). As defined in Wikipedia (n.d.), succession planning is a process for identifying and developing internal people with the potential to fill key leadership positions in the company. Succession planning, sometimes called succession management to emphasize the active and continuous nature of the effort is a process for preparing people to meet an organisation’s needs for talent over time. Rothwell (n.d.) defined succession planning as any effort designed to ensure the continued and effective performance of an organisation, division, department, or work group by making provision for the development, replacement, and strategic application of key people over time. Russo & Mitchell (2005) in the American Society for Training & Development (2010) defined succession planning as the process of identifying key positions, candidates or the employees needed to meet the challenges that an organisation faces in the short term and in the long term. As Robert and Turknett (n.d.) put it, succession planning is a systematic process designed to:

- identify key leadership positions and hard-to-fill positions;

- identify the critical competencies that employees in those positions require; and

- prepare for their replacement to ensure the continued ability of an organisation to meet its strategic goals and supporting objectives.

Succession planning does not exist in isolation. It is interwoven with the organisation’s strategic objectives and should reflect the way the company needs to evolve in order to achieve its strategic goals. This means that the kinds of leadership styles, skills, and behaviours to be developed and promote might be different in the future from those in the existing culture. Current conditions consist of the rapid growth of emerging technologies, a demand for more public accountability, heightened expectations by company members, fierce competition (including time competition), and the stewardship of sustainable growth and value, to mention a few. What do these trends and changes mean for the type of leadership that will be required for the organisation to succeed in such a “new world?”

Although succession planning is often confused with replacement planning, succession planning goes beyond replacement planning because its focus is broader than one position, department or division (Rothwell, 2005). It also differs from replacement planning because successors are considered by level on the organisation chart. Succession planning is an integral process that begins long before the outgoing leader departs, and it presents a remarkable opportunity to move forward with a new understanding of the complexities, challenges, and changes which the organisation must address. Succession planning is therefore the preparation to replace one leader with another (Mamprin, 2002). Succession planning is usually based on the assumptions that (Rothwell, 2007):

- A goal is to identify a talent pool of many people who are willing to be considered for promotion and work to be developed for it.

- The future may not be like the past, and the competencies required at each level may be different in the future so that merely “cloning” past leaders is not appropriate

- Development occurs primarily on the job rather than by off-the-job training experiences.

It can be said that the ultimate goal of leaders is to work themselves out of their jobs. Effective leaders plan an exit that is as positive and graceful as their entrance was. They come to the job committed to the mission and goals of the organisation and to their personal goals. When those goals are realized, the transition to new leadership becomes a primary focus. An excellent successor becomes, literally, the ultimate leadership responsibility.

The most obvious reason for having a succession plan is to provide for a dealership owner’s transition into retirement. Because of this, many people have a tendency to confuse succession planning with exit strategy planning. However, there are other reasons for succession plans in a company. The focus of this paper is to provide some insight into why succession planning is so important and to outline a plan that can be followed to create a succession plan that will provide a positive outcome.

1.1 Why plan for business succession?

Effectively done, succession planning is critical to mission success and creates an effective process for recognizing, developing, and retaining top leadership talent. According to Canada Business Network (2012), a good business succession plan will help make the transfer of business to go smoothly, and allow the business owner to maintain good relationships with employees and other business partners. Thus, succession planning helps the business owner to:

- Protect the legacy of his/her business

- Maintain a service for the community

- Build value for the business

- Provide financial security for his/her family and other stakeholders

- Deal with unexpected events (illness, accident or death)

- Prepare for the future

Furthermore, Canada Business Network (2012) indicated that business succession plan can help business owner make important decisions about ownership, maximizing his/her company’s value, tax matters and that such plan should touch on some of the following areas:

Goals and objectives

- Develop a vision for the business.

- Determine your retirement or post business ownership goals.

Decision making

- If appropriate, involve family members in the development of the plan.

- Have a conflict resolution mechanism — a pre-established plan to resolve any conflicts between family members, partners and/or employees.

- Select a successor.

Training

- Identify the core skills and competencies that the potential successor will need.

- Plan for the training of the new owner(s).

Estate planning

- Prepare a financial plan and determine the tax implications of the transition of the business.

Contingency planning

- Have a contingency plan that includes the financial resources required to ensure the survival of the business in case of illness, accidents and even death.

Corporate structure and transfer methods

- Determine available options as a sole proprietor, partner or owner of a corporation.

- Decide whether the business owner wish to transfer or sell the business to the potential successor.

Business valuation

- Find out the fair market value of the business.

Exit strategy

- Establish a timeline for easing his/her way out of the business

Implementation and follow up

- Review and update his/her plan regularly.

On this issue of business succession planning, Canada Business Network (2012) counselled on the need to contact key advisors such as Accountants, Bankers, Lawyers and Insurance broker when developing the succession plan and that communication with the potential successor(s) is important in order that they understand their roles in the business and collaborate in the transition process.

You must control your present to impact your future. The best way to predict the future is to create it.

2.0 ELEMENTS OF SUCCESSION PLANNING

There are two types of succession that can occur, a planned succession and an unplanned succession. When the transition is planned in advanced, the process can and should be a much smoother one. Using the succession chart below, a replacement should be indentified and trained for the post. When taking over as the most senior manager in a company, the successor must understand what makes the business tick. He or she needs to understand all aspects of the business from sales and service to admin, cash flow and financials. If the successor does not have the ability to step into the entire role of the business owner, then he or she is not ready. An unplanned succession planning is another story entirely. A sudden need for replacement is usually due to a catastrophic event. In this case a plan needs to be worked out in advance that outlines the steps required to safeguard the company and keep things on track.

One element in succession planning often overlooked is the need for oversight. The business is most vulnerable in the event of an unplanned succession. If the owner or leader of the company is unable to work, the team can be left without the leadership needed to succeed. What if something is to happen to the owner/founder of the company or one of the key managers or employees? These unplanned events could wreak havoc on the business. With no plan in place those left behind are left scrambling to come up with a plan. In many cases, this plan has simply been to sell the business or simply wind up the practice in case of real estate practice. Companies are gradually waking up to the fact that there are costs and pain associated with not having a succession planning strategy in place.

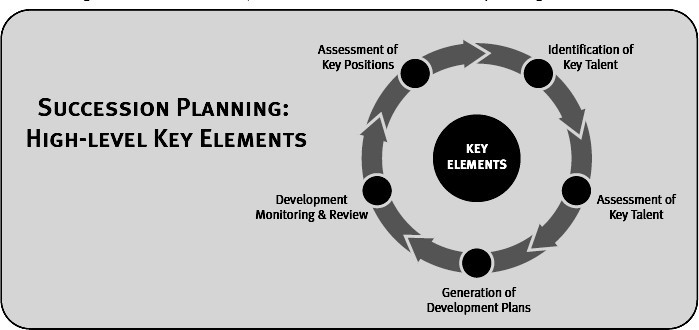

SuccessFactors, Inc. (2008) indicated that effective succession planning relies on three best practices, regardless of the industry in question. These best practices are as follows:

a. Define the Process: There are several key elements to designing a process that is both comprehensive and tailored to your company. The first step is the assessment of key positions. What are the roles in the company that are critical to the business? This is a thorough survey of key positions across the company. Once the key positions have been assessed, then the next step is to thoroughly assess the key talent in the Once these first two steps are completed, the business owner can begin to generate development plans for grooming individuals and strengthening his/her position in all the critical areas of the business. The focus is on the high potential employees and how to develop and retain them. It also allows the business owner to identify areas of improvement. Finally, creating a consistent, ongoing monitoring and review process is crucial to solid succession planning.

Chart illustrating the key elements for effective succession planning

Source: SuccessFactors, Inc. (2008).

b. Continuous Review: Once the process of assessing and identifying employees at all levels of the company has taken place, business owner should have a good idea of the depth and scope of available talent. The next most critical step is discipline. While succession planning can effectively guide identification, development and retention, the process breaks down if the data is not analysed, evaluated and updated One way to reinforce a consistent succession planning process is to tie a talent review process to performance reviews. This allows the business owner to piggy-back on an already-defined event and adds important insight: simultaneous measurement of current performance against a talent assessment helps validate decisions and planning for those employees whom the business owner feels will be of most value to the organisation. In fact, the business owner may not receive the full benefit of a performance review process if he/she does not take action to address gaps surfaced during the review and to develop the skills employees need to succeed in their current or future roles.

c. Applying Technology: Designing, implementing, and executing an effective succession planning process can be time consuming and challenging. A paper-based system is not viable because there are simply too many variables to be assessed. Just collecting and analysing data on its own to drive assessments for every employee alone is a massive undertaking. Once information is collected, keeping it current, centralised and easily accessible to key management staff with the right permission is very difficult when documents are kept in binders or file drawers throughout the Fortunately, there are innovative performance and talent management technology solutions available that dramatically facilitate the entire succession planning process. Applying technology allows business owner to have intuitive and easy to understand views of their team — including readiness and risks of someone leaving – as well as greater access to successor candidate pools through flexible search tools. But this comprehensive view of a company’s talent pool and bench strength is only possible using today’s powerful technology designed especially for succession planning.

3.0 ROADMAP TO EFFECTIVE SUCCESSION PLANNING

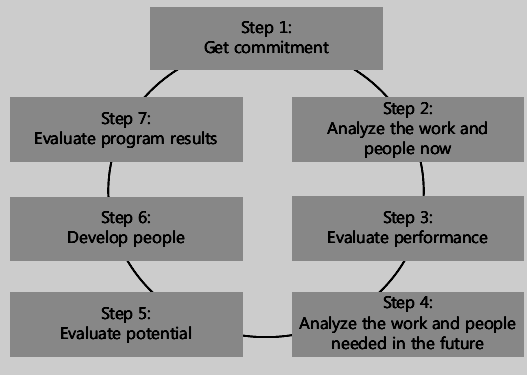

As indicated by Rothwell (2007), a good succession planning program will be organized around a roadmap that integrates all its components and emphasizes the internal development of existing employees in the organisation. The chart below illustrates an example of a succession planning roadmap and step-by-step description of this roadmap; as proposed by Rothwell (op cit).

Key Steps to Effective Succession Planning Program

Source: Rothwell (2005a).

Step 1: Get commitment: No succession planning program can work without business owner and employees at all levels clearly understanding why a succession program is needed. A compelling case must be made for it. At the same time, executives, managers, supervisors and employees must clearly understand their role in the program.

Step 2: Analyze the work and the people now: To prepare successors, business owner must know what work is done, how it is done, and what kinds of people do it best. This step requires the creation of up-to-date job descriptions, clear work outputs and work accountabilities, and job competency models to describe the characteristics of the people who do the work best.

Step 3: Evaluate performance: Step 3 refers to performance management, the process of planning, managing and appraising worker performance over time. This step is important in a good succession planning program because individuals must be held accountable for the work they do, the responsibilities they shoulder, and the competencies they demonstrate. It is worth emphasizing that it is not enough to have any performance management system; rather, the performance management system must measure people against what they are expected to do, what results they are expected to achieve, and what competencies and behaviours they are expected to demonstrate.

Step 4: Analyze the work and people needed in the future: The future will not necessarily be like the past. In this step, decision makers align the organisation’s strategic objectives with the work and competencies needed to realize those objectives. The organisation’s future requirements should be driven down to each level, job and function. The result should be expected future job descriptions and future competency models.

Step 5: Evaluate potential: The potential for promotion to higher level responsibilities should be considered against the backdrop of the future. In other words, every individual who seeks promotion is really working to be developed on an escalator because the competitive environment within which the organisation performs is not static. Things are changing as individuals are being developed. It is not enough to assume that successful performance in the past will guarantee successful performance in the future. Instead, organisational leaders must find objective ways to determine how well individuals will function at a future time and at a higher level of responsibility.

Step 6: Develop people: This step focuses on closing developmental gaps found by comparing the results of steps 4 and 5. To carry out this step successfully, organisational leaders should establish an individual development plan (IDP) for each employee to narrow gaps between what the individual does now and what he or she must do successfully in the future to function at higher levels of responsibility. An IDP is like a learning contract. It is usually negotiated between an individual and his or her supervisor on an annual basis. Individuals are encouraged to identify, and plan for using, resources to help them build the competencies they need at higher levels of responsibility. Resources may include training courses inside the organisation, seminars or conferences outside the organisation, internal job rotation experiences, and many other competency building efforts.

Step 7: Evaluate program results: How can the results of a succession planning program be evaluated? The answer to this question must be obtained by measuring program success against the objectives established for the program in Step 1.

It must be realised that succession planning and development of future leaders does not exist in isolation – it needs to reflect the company’s strategic objective and strategic goals. For any organisation to implement an effective succession plan, the following key issues may need consideration (Ameinfo.com, 2005):

- A system for communicating succession planning information to key personnel in the organisation must be established.

- A systematic approach for identifying, nominating and selecting potential successors must be established.

- Background information on potential successors, such as education, experience, skills, appraisals and potential should be reviewed.

- Critical positions must be identified and included in the organisation’s succession planning program.

- Identify high-performers that are almost ready to step into those critical positions.

- Identify the required skills the organisation will need now and in the near future.

- Business owner need to identify the responsibilities, skills and competencies that will be needed by their replacements.

- Succession planning must be part of an integrated HR process that includes training, development and performance appraisal.

- Succession planning must include a system for providing feedback and encouragement to potential successors.

- The skills of potential successors must be developed through work experiences, job rotation, projects and other challenging assignments.

- The training and development requirements of potential successors need to be determined.

Succession planning is not something a well-run company can ignore because the consequences of not being prepared to replace key personnel will have a major impact on an organisation’s ability to achieve its goals and strategic targets. Thus, succession planning process need to be considered as part of the company’s strategic planning process because it deals with projecting future changes by anticipating management vacancies and then determining how to meet these challenges. In its simplest form, succession planning is nothing more than getting business owners to use a systemic process to determine the current training and development requirements of their subordinates.

3.1 Importance of Succession Planning

Many organisations lack succession plans, a situation that sets them up for various types of failure. The only viable option is to commit to instituting a succession plan, acting with a keen sense of purpose, strategic direction, urgency, and unwavering commitment. Succession planning success requires a proper sense of strategic direction coupled with having the right controls in place, such as policies and guidelines that are tied to measurable outcomes. Engaging the organisation’s stakeholders in the implementation and the execution of the succession plan is critical. The executive leadership team must ensure that the plan is executable; announce the plan; properly introduce the plan, genuinely validate its need; and effectively communicate the mission, vision and objectives of the plan with determination and firmness.

Simply put, succession planning has the power to transform how business owners manage the future of their talent — from top to bottom — in order to positively impact bottom-line results. Done very well, it drives an ongoing, proactive dialogue between business owners and key personnel that identifies and tracks the individual talents in key positions. Business owners can then put key contributors on a growth path where they can be most valuable to the company. Key benefits include (SuccessFactors, Inc, 2008):

- Strengthen the talent pool: By helping business owner identify potential skills and competency gaps, companies can proactively train and groom talent across all key positions in the organisation. For example, a contributor with deep corporate “smarts” and knowledge of the business-critical processes is always difficult to A departure in this situation can create a serious business continuity issue — especially when the business owner cannot hire someone with that same intimate knowledge through an outside party. Succession planning provides proactive identification of these important “go-to” employees who can be further groomed for the job without losing the knowledge base which the company depend on.

- Better career development: Succession planning facilitates genuine development of employees — for both their own benefit and that of the organisation. After identifying an employee with high potential, it is understandable that a smart company will help train and support that individual in a way that also moves their career forward. There is a reciprocal aspect to this effort: open development compels employees to go the extra mile and stick around longer with the understanding that they have a future in the organization.

- Time savings: When an employee unexpectedly leaves, the time and stress involved with interviewing, hiring, and ramping up a new employee is a burden to any company. Effective succession planning translates to a definitive plan — and reassurance — that the organisation can dramatically reduce the effort to replace a key contributor by literally having the right replacement strategically engaged and ready to step in.

- Cost savings: There are two primary ways that succession planning delivers measurable cost savings. The first — and most obvious — is in avoiding the significant out-of-pocket expense incurred by using a third-party placement agency or head- Secondly, the cost of reactively focusing on hiring and ramping-up a new employee. When a key contributor leaves, it can often take 6 – 9 months to bring a replacement up to speed — clearly, a huge hit to productivity at many levels of the company. While some organisations might dismiss this as a cost of doing business, they would certainly think differently if they could get a real-time report providing hard figures on the cost of employees spending time on trying to fill a position, instead of working on their revenue-generating responsibilities.

4.0 SUCCESSION PLANNING IN PROFESSIONAL SERVICE FIRMS

Succession planning increases the availability of experience and capable employees that are prepared to assume leadership roles as they become available. The pending retirement of the business owner and the unrelenting challenge of finding and keeping talented staff can have grave consequences for firms that fail to develop a succession strategy. Succession planning is not limited to a single course of action. It involves evaluating different aspects of the firm and identifying systems, processes and policies that need improvement in order to position the firm for succession regardless of company’s owner exit strategy. Options for succession include internal transition, practice continuation with other firms / merger, or turning out the lights when it is time to retire or when the firm owner dies.

What makes succession planning for professional service firms so difficult? Many professionals believe they will practice until the day they die. Age may slow them a little but they will just reduce their workload and carry on as usual. Thinking about succession is not on their agenda at all. For others, particularly in occupations based around having developed a personal relationship with their clients, there is a natural reluctance to let go of their book of business because of its importance in terms of status, compensation and leverage. Succession planning can be seen as a threat to their security and their reputation. In such circumstances even broaching the subject of succession can raise barriers and harm relationships among partners. It is little wonder that professional services firms have such a tough time confronting the issue of succession. A management succession plan that operates as part of the regular management practice of the firm, which is recognised as applicable to each partner in their turn, is the most politic (i.e. marked by artful prudence, expedience, and shrewdness) approach and the one that offers the best chance of a smooth and good for the business way of dealing with succession in these circumstances. The two key elements to achieving these are:

- Having the necessary agreements relating to succession issues in place, and

- Working to a succession plan that rolls out over a long term period

Succession practice for professional services firms is one of those management issues that rarely get attention until a partner announces plans to leave or retire, or more disastrously, is suddenly removed by illness or death. Whatever the circumstances, the situation often throws a firm into crisis mode. A smart professional services firm will plan for the broad spectrum of issues associated with partner departure well before the event occurs. Many of these issues are long-term in nature and can take years to phase in. They are best managed in the context of a long-term succession planning program geared to achieving the firm’s strategy for identifying and addressing the gaps in capability that will inevitably occur from the face-down and retirement of a partner. This approach provides both the best strategy for ensuring the firm continuing success as well as the most politic manner of managing the personal issues raised by succession.

Research indicates many succession-planning initiatives fall short of their intent in estate firms because succession is one of those things everyone dreads and tries to avoid but without it, the business could suffer, or even fail, if something were to happen to the Managing Partner/Director unexpectedly. For that reason, it is never too early to start thinking about succession planning. After all, it is likely that, as the owner of a business, the success of your company is the main source of your economic stability, and it would be foolish not to plan for the future of your company.

A succession plan may develop over several years, and is constantly changing based on the state of the real estate business; fortunately there are steps that can be taken to ensure a successful future for you and your company. Succession planning is not just crucial in the event of death, but can be helpful should a partner in a multiple-ownership company want to take his or her exit. Without a plan in place of how the exit issue scenarios should be dealt with, the continuity of that business could be in serious doubt. Many business owners hope to see their business continue to exist after they are no longer alive. In that case, he/she will need to choose a successor, someone that he/she not only trusts, but whom can be groomed to carry out the business owner’s wishes for the company.

4.1 A Five-Point Plan for Effective Transitions

A successful company leadership succession plan should maps the landscape, prepares for contingencies, and minimizes disputes. Simultaneously, such company needs to enable an orderly transition, ensure continuity, and build a legacy. Will it achieve these goals? According to Alana Healy, Executive Director of a Canadian micro-company, innovative approaches to leadership such as shared or co-leadership should be considered. Healy also states that a successful company succession process begins with a solid foundation, intention, and a deliberate architecture to ensure success. The following five-step process can provide a strong framework for effective succession practice.

Step 1: Building a solid company foundation: The key to a successful succession plan lies in building a solid foundation of profitability and growth for the company. This happens long in advance of the actual succession date.

Step 2: Co-developing the leader’s exit strategy: Leaders should start with the end in mind. Any sound and successful strategy begins with a goal or vision of the desired outcome. The company leader co-develops a solid framework that acts as a road map for successfully navigating the challenges of the modern company world – including the exits and integrations of outgoing and incoming CEOs or executive directors. A company’s board and key management staff must be involved with and support this succession planning process. Succession planning also must be “owned” in part by all staff. From the board standpoint, defining a clear vision for future leadership might mean setting up a board-appointed search committee that could include staff representation. One task of this committee would be re- examination of the company’s defined vision, as well as identification of major issues the organisation likely will face in the next five to 10 years. The vision statement would be shared widely and could describe both the nature of the company 10 years hence and the qualities required of the new chief executive to lead toward that vision. If the current leader and senior staff team were right for yesterday and today, the new leader must be equally right for tomorrow.

Step 3: Minimising the company’s risk: In many cases, the illness, serious injury, or even the death of a business owner or company leader can be devastating and can mean peril for an organisation. The risk-related component of the succession plan ensures that the company, its members, and its staff are protected in the event of an illness, accident, or disability related to the top staff leader. Proper legal documentation, such as stakeholder agreements, insurance policies for key persons, and business and financial plans, must be in place. A good attorney and insurance consultant can help organise and ensure a company’s efforts are comprehensive and well-implemented.

Step 4: Strengthening systems and processes: Strong companies must deploy strong management and strong systems. Critical factors that create value at the end of the day for any company are continuous organisational improvement, membership focus, high-quality value offerings and services, and the finding, hiring, and training of the best possible staff. Essential competencies that a company needs in the future include:

- Building the successor’s business and leadership skills

- Planning the development and retention of key persons

- Creating an effective company structure

- Developing management systems for peak company performance

- Documenting systems and procedures to create efficiencies and support the effective transfer of knowledge

- Implementing a proper strategic planning process that includes leadership transition

- Hiring and training the best possible staff

- Having accounting and financial controls and a comprehensive marketing plan

Step 5: Transitioning the leadership: The next step is to identify gaps between the required leadership and the existing talent pool. The organisation must decide if a new leader can be promoted from within or if an external search is required. It also must ensure that the future vision of the organisation is fresh and vital, so the selection of the new leader is based on choosing the right person to lead the organisation to the new vision. Another important task is determining the type of actions that will ensure a good fit between a potential leader and the organisation’s culture. Matching the leader to the desired culture is critical.

Ideally, the incoming successor works with the outgoing leader for a period before taking office, although the current CEO carries full responsibility for the organisation until the day he or she leaves. This helps support some of the critical learning required by the new leader for them to be successful.

Business owners spend much time thinking about how to drive the company successfully forward, but they usually spend far too little time thinking about the right time and the way to leave. A successful transition can be a seamless, productive, and unifying experience. Most people will be remembered, in work and in life, for just a few words or deeds that made a difference to others. The way leaders choose to say good-bye is likely to be one of the ways they are remembered. If they execute their final leadership responsibility with the same care and attention that they gave to the first, their departure can be an inspiring gift to the firm and staff.

4.2 Choosing a Business Successor

Choosing a successor is a process in itself that should be carefully thought through. Clear objectives are critical to establishing effective succession planning. Setting clear objectives will help:

- Identify those with the potential to assume greater responsibility in the organisation;

- Provide critical development experiences to those that can move into key positions;

- Engage the leadership in supporting the development of high-potential leaders;

- Build a data base that can be used to make better staffing decisions for key jobs;

- Improve employee commitment and retention;

- Meet the career development expectations of existing employees; and

- Counter the increasing difficulty and costs of recruiting employees externally.

According to Matthews (2001), choosing a business successor entails choosing someone who is not only ready for the job but has the respect of key team members and the wherewithal to guide the organisation or company into the future. In the evaluation of the most suitable successor , it will be imperative to ask some key questions about the business and its direction (Matthews (2001) quoting Leslie Dashew, the President of the Human Side of Enterprise and Partner at the Aspen Family Business Group in Scottsdale, Ariz). The answers will provide a context in which a competent business successor can be chosen. As indicated by Dashew, Chief Executive Officers (CEOs) of companies doing succession planning often do one thing terribly wrong, which is “People tend to choose people they’re comfortable with, people that are like themselves, and that’s not always the right person.” For instance, a father may want his/her child to be the next successor.

Robinson (2012) indicated that initiating a succession planning process is not easy. Difficult questions must be asked, both by and about management and other stakeholders. This type of introspection, analysis, engagement, and deliberate action is required to shed true light on the situation at hand, and to honestly answer the following strategic questions: Where are we now with our succession efforts?; Where do we want to go?; How are we going to get there?; and, What key action steps are needed to assist us with our forward progress? Leslie Dashew as quoted by Matthews (2001) suggested that instead of looking for someone who is similar to outgoing CEO, the organisation should do some strategic analysis by asking and providing answers to the following questions:

- Where do you want your company to be in the future? Don’t hire a successor for where your company is, but a successor should be hired based on where the company wants to be in the future. Outgoing CEOs have to realize that leading their companies into the future is going to take a different set of skills and perspective than they have, and thus have to evaluate candidates accordingly.

- Who are the stakeholders? Who are the owners? Family members, employees, investors, a key management group? Who will this person report to? The person should engender trust and confidence among the owners of the Leslie Dashew opined that different scenarios will engender different experience for each type of owner and that in each scenario. For instance, if the company is going to go public, you’ll want someone with that experience. If the owners are family members, the successor should be someone with whom they are comfortable. And if it’s investors, be warned that those stakeholders will undoubtedly want to have input on whom the successor will be.

- What core competencies needed in the successor? As a departing CEO looks at where the company is going, he or she should also look at the leadership talents the business will need to get it there. “Personality should be only one consideration. Other competencies such as strategic thinking ability, probably some kind of financial analysis capability, the ability to manage other executives or other managers,” Dashew says. While there are many standard core competencies, like the ability to communicate well, you must also think about those competencies that are specific to your situation or industry.

- Can the potential successor work effectively with the management team? According to Dashew, choosing a successor who is good with collaborative management or collaborative leadership is key. If a successor doesn’t work well with you, the management team, and/or the other stakeholders, then the successor is doomed to failure.

- How effectively will the successor work with all the company’s stakeholders including the bank, auditing firm, legal team, customers and all other external influences? Establishing a sense of continuity during succession is important, and maintaining key relationships is paramount in this sense. If a successor strains or breaks business relationships, it could undermine your business’s stability, and ultimately cause employees to leave or put your business at financial risk.

- Is it clear about what authority that might be given to the potential successor and what authority might be retain by the current chief executive officer? In many cases, a CEO will bring in a successor and then jump into the role of chairman, but it is not clear what decisions the new CEO can make and what power the old CEO will retain. “A big issue is letting go of the power,” says Dashew. Make sure that you are ready to give up control, that you know what that means, and that it’s clearly communicated to your successor.

- What are the values that are most important to the incumbent CEO that clearly define the organisation’s culture? You must be sure the successor demonstrates commitment to those same values your company was built on. “It’s one thing to say that I believe in a participative leadership style, it’s another thing to have done that,” Dashew The candidate should exemplify that he or she has those values, not just agree with them.

- Has the incumbent CEO cultivated a team of people who can give effective support to incoming successor? To really succeed in the new position, the successor has to be readily accepted by the team. He or she needs support, and without the teams buy in, you risk undermining the succession process and jeopardizing your business’s future.

According to Robinson (2012), succession planning has a future orientation, but it also has a sprouting present orientation. Thus, organisations must be doing something right now. They must first admit that they have no plan; then, they must be honest about why there is no plan and what it will take to develop one, and when one will be developed. They must then be honest about their available resources (financial, physical, human and organisational) and capabilities (technological) that are available to construct, implement and sustain the plan either in the short- or long-term. The plan needs to provide a clear line of sight about identifying, assessing, and developing future leaders and senior/branch managers (including departmental heads), as well as individuals to fill mission essential positions and roles throughout the organisation. The plan should be strategically aligned with training and development activities.

“In life we can have results or reasons. If you are not getting the results you want, your reasons are the lies that you keep telling yourself.”

Harald Anderson

4.3 Succession Planning Best Practices

As indicated by Matthews (2001), succession planning is, to some, an admission of their own mortality. But without a plan, business owners miss out on being able to ensure business continuity and future direction. Thus, aging business owner also risk creating extra trauma for their businesses when there could already be trauma due to some unexpected accident or event. Bradford cited in Matthews (2001) suggested that starting with the understanding of two things about the business owner or chief executive officer’s (CEO) role: balance and function. “A CEO needs a sense of balance” Bradford says. The CEO role balances finances, marketing and operations, and depending on what background the potential successor is coming from, the CEO should evaluate what the person’s perspective is and discover ways to give the candidate the perspective that will allow him or her to balance their history or career with the new role. Second, the CEO’s function is often that of visionary. CEOs spend a good deal of their time deeply involved in strategic thinking, and therefore, a CEO needs to involve a potential successor in his or her strategic thinking process. “Give him or her chance to learn by doing”, Bradford says. You need to be able to grow the next CEO into the job as your company grows, which entails knowing the business’s direction as well as CEO responsibilities.

According to Bradford cited in Matthews (2001), once there is an understanding of the new sucessor’s role, then the need to put a plan into place. In this regard, Bradford offers the following steps:

- Evaluate the resources you have at your disposal. The most important resource for this is time. How much time can be devoted to this? It will be necessary for the retiring business owner to sit down and write down his thoughts about the company including the company’s vision and mission. It is also important to know whether there are other employees in the company with the skills to assess potential Most business owners should have this skill inside the company already since it is a skill many CEOs themselves possess, but if not, you may need to seek an outsider to help in the assessment. Lastly, money may be an issue. If there is need for a consultant in assessing candidates or drawing up a succession plan, there is need to adequately budget for this. For smaller organisations, it might not be wise to spend money on this type of development unless you entirely lack the in-house resources to successfully assess candidates and put a plan in place. “For larger companies, it could be money well spent, as the company won’t waste time reinventing the wheel,” Bradford says.

- Fully engage all the stakeholders. There are many stakeholders in succession planning, and it is important that each be brought into the process in a timely manner. This process starts by engaging the board in the development of a forward-looking skills-and-experience profile for the business owner. The profile should be a living document refreshed as necessary to take changes in strategy or market conditions into consideration. It should also go beyond the traditional position description and delve deeply into both the competencies and experiences required for the next leader. It can then be translated into a dashboard for grading succession candidates in an objective

By engaging the entire organisation, potential weaknesses about the succession plan can be identified; these weaknesses were probably not visible to the management team prior to undertaking the succession planning process. It will ultimately enable the organisation to uniquely position itself in the succession planning process, and give the organisation the line of sight needed to identify core resources (tangible/intangible), core capabilities, competencies, and the strategic value of each one. Tangible resources (financial position, technology, and internal expertise) are assets that can be seen, touched and quantified. Yet intangible resources are important too, and range from intellectual property rights to reputation and culture (leadership, support, process flexibility, technical knowledge, employee engagement, innovation, and morale, commitment to succeed and implement the plan, and overall focus). These are critical strategic factors that must be considered.

- Analyze and record what your function in the organisation is and the value that the business owner creates. The retiring business owner should start by writing down his own job description. He needs to think about what he spend his time doing and what do he does particularly well. If he has a lot of time to devote to this, he might want to keep a log of what he does from week to week, suggests Bradford. He might even want to consider bringing in an outsider to assess what he does if the company has adequate resources to do so.

- Look at people in your organisation and figure out which people could do your job half as well as you. “I don’t believe most business owner believe anybody could do a job as well as they do,” Bradford says. He suggests looking at the three or four most critical elements of the CEO’s job and picking out the main skills required to be successful in the role. “For example, in a company where the business owner has a big marketing function that involves combining an understanding of the customer, some statistical analysis, and a vision for what the company will do to create value for the company’s clients. Consequently, the retiring business owner will need to examine a candidate’s skills in the following areas: leadership, marketing, finances, and “The leadership skill is probably the most important,” Bradford says. “It involves a difficult balance of knowing when to push, to check, to actively manage people, and when to step back and let them do things they can already do very well.” The key to the success of an internal succession planning analysis is the ability to identify the value proposition of the plan, which highlights an organisation’s future and offers stakeholders a sustainable and strategic sense of direction to take the next steps.

- Take the people you think could do the job and have them do a self-assessment. “You want to look for someone who can be honest with him or herself,” says Bradford. The assessment should include questions that help the individual evaluate his or her weaknesses in key leadership areas. According to Bradford, the assessment should include questions like:

- What are my strengths and weaknesses as a manager? What tasks do I perform well, and what tasks should I delegate to others? (In most organisation s, you will want to break this down into the following categories: Leadership, Financial, Sales/marketing, operational/technical, and )

- Do I have the perspective (operational, financial, market) to drive a balanced vision for the company? If not, what perspective do I need to add to my current level of experience?

- What would I need to learn if I were going to become CEO?

- What kind of help will I need to be a good CEO?

- Compare your job description with your potential successor’s self-assessment and develop a plan based on the gaps. “What are the gaps between what they need to be good at and what they are good at,” says Bradford. Consider how this person is going to grow and be able to do your job and devise ways to get them there. When Bradford succeeded his father in business, he evaluated his skill set and compared them to his father’s. It turned out that he had work to do, and they created a plan to ensure he received the skills. “I looked at what he was doing and asked him if he felt I could do those tasks,” Bradford says. “I would put time on my calendar to participate in any activity where I felt I needed to learn something.” Encourage your potential successor to become actively involved with the learning process, evaluating his or her readiness, and then offer him or her paths to take to acquire the necessary skills.

- Start grooming. How you prepare the next in line will vary based on your corporate culture, but Bradford believes that exposing your candidate to your strategic thinking process and planning is a good start. Have the candidate get involved in the strategic Help him or her embody what your vision for the company is, because after all, sustaining your vision of the company is really why you’re choosing a successor.

Many organisations lack succession plans, a situation that sets them up for various types of failure. The only viable option is to commit to instituting a succession plan, acting with a keen sense of purpose, strategic direction, urgency, and unwavering commitment. Succession planning success requires a proper sense of strategic direction coupled with having the right controls in place, such as policies and guidelines that are tied to measurable outcomes. Engaging the organisation’s stakeholders in the implementation and the execution of the succession plan is critical. The management team must ensure that the plan is executable; announce the plan; properly introduce the plan, genuinely validate its need; and effectively communicate the mission, vision and objectives of the plan with determination and firmness (Robinson, 2012).

5.0 CONCLUSIONS

What is Succession Planning and what role does it play in your organisation? As indicated by Stensgaard (2007), succession planning is nothing more than having a systematic process where business owners identify, assess and develop their employee to make sure they are ready to assume key roles within the company. Succession planning is about developing and implementing a system, a practice of activities on a recurring basis. Then, when an employee leaves, the system almost naturally refills the position with the most suitable candidate (McNamara, 2010). Having this process in place is vital to the success of the organisation because the individuals identified in the plan will eventually be responsible for ensuring the company is able to tackle future challenges. These “high potential” candidates must be carefully selected and then provided training and development that gives them skills and competencies needed for tomorrow’s business environment. These high potential candidates will one day become the leaders of the company. This is why their development needs to incorporate a broad range of learning opportunities in the organisation concerned. The individuals should also be exposed to as much of the working environment as possible so that they gain a good understanding of what the company requires to remain successful.

Succession planning is an active process, requiring business owners to have a clear ‘line of sight’ (LOS) that allows them to establish clear objectives and take deliberate action. Given the dynamic nature of modern organisations, business owners can no longer afford the luxury of simply hoping they find suitable candidates to fill key roles. Frequent turnover and transitions, an aging workforce, and economic instability are but some of the forces that create situations of uncertainty with respect to job longevity, even at the highest levels of an organisation. As such, succession planning should be recognized as an active, ongoing process that requires continuous preparation and monitoring. “Without light, there could be no ‘Line of Sight’ (LOS).” Regardless of industry or sector, “succession planning” is an active process, requiring business owner to have a clear ‘line of sight’ (LOS) that allows them to establish clear objectives and take deliberate action. Given the dynamic nature of modern organisations, business owners can no longer afford the luxury of simply hoping they find suitable candidates to fill key roles. Frequent turnover and transitions, an aging workforce, and economic instability are but some of the forces that create situations of uncertainty with respect to job longevity, even at the highest levels of an organisation. As such, succession planning should be recognized as an active, ongoing process that requires continuous preparation and monitoring (Robinson, 2012).

Finally, organisations that understand the need to manage the development of their high performers are a step ahead of their competitors. The effort required to establish a development program for future leaders or successors is worthwhile because it creates a motivated and capable group of employees that are ready to move forward in the organisation when the need arises. Effective succession planning can help ensure that the company concerned maintains leadership in key positions, ensures business continuity, retains and develop intellectual capital and encourages individual development.

REFERENCES

4imprint.com. (2009). Succession planning. Retrieved on July 10, 2012 from http://info.4imprint. com/wp-content/uploads/Blue_Paper_ Succession_Planning.pdf

Aberdeen Group (2006). Succession planning strategies: The right people, for the right jobs, at the right time. Retrieved on July 17, 2012 from http://www.insala.com/RA_Succession Planning_DF3682.pdf

AMEinfo.com (2005). Why is succession planning important? AME Info FZ LLC, A 4C Service | HR and Training | Retrieved on July 10, 2012 from http://www.ameinfo.com/59276.html

American Society for Training & Development (2010). Improving succession plans: Harnessing the power of learning and development. AN American Society for Training & Development (ASTD) Research Study. Retrieved on July 10, 2012 from http://e3lg.com/assets/files/ articles/Improving%20 Succession%20Plans.pdf

Anne-Birte Stensgaard (2007). Why is succession planning important? AME Info FZ LLC. Retrieved on September 19, 2012 from http://www.ameinfo.com/59276.html

Bergholz, H. (2006). CEO transitions: Points to consider. Jeslen Corporation. Retrieved on July 20, 2012 from http://www.nickols.us/CEO Transitions.pdf

Byham, W. (2002). A new look at succession management. Ivey Business Journal, 66(5), 10–12.

Canada Business Network (2012). Succession planning. Retrieved on September 4, 2012 from http://www.canada business.ca/eng/page/2819

Cingoranelli, D. (2009). A 2009 Tune-up for Your Firm’s Succession Planning. Retrieved on August 2, 2012 from http://www.journal ofaccountancy.com/issues/2009/mar/tuneup yourfirmssuccessionplanning

CIPD (2012). Succession planning. Retrieved on August 14, 2012 from http://www.cipd.co.uk/hr-resources/factsheets/succession-planning.aspx

Coaching Businesses to Success (2006). Delivering results. Retrieved on July 10, 2012 from http://www.coaching-businesses-to- success.com/delivering_results.html#SMARTFirefox HTML\Shell\Open\Command

Coaching-businesses-to-success.com (2006). Succession planning. Retrieved on July 10, 2012 from http://www.coaching-businesses-to- success.com/succession_planning.html

Edwards, B. (2008). 8 mistakes made in succession planning … and how to fix them.

Linkage. Retrieved on October 3 10, 2012 from http://www.linkageinc.com/thinking/linkageleader/ Documents/Bob_Edwards_8_Mistakes_Made_In_Succession_Planning_and_How_to_ Fix_Them_0408.pdf

Frisch, R. A. (2002). ESOP workbook: The ultimate instrument in succession planning. John Wiley & Sons.

Goldsmith, M. (2009). 4 tips for efficient succession planning. Retrieved on July 10, 2012 from http://blogs.hbr.org/goldsmith /2009/05/change_succession_planning_to.html

Griesedieck, J. & Sutton, B. (2007). Completing the CEO succession planning picture.

Korn/Ferry International. Retrieved on August 15, 2012 from http://www.kornferry.com/Library/View Gallery. asp? CID=3101&LanguageID=1& RegionID=23

Hills, A. (2009). Succession planning – or smart talent management? BlessingWhite, Inc.

Princeton, NJ. Retrieved on July 19, 2012 from http://www.blessingwhite.com/content/articles/ Succession_ Planning_by_AH.pdf

Infoentrepreneurs.org (2009). Succession planning and business transfer. Retrieved on July 28, 2012 from http://www.infoentrepreneurs.org/en/guides/succession-planning- and-business-transfer/

Jo Dale, LSIS Associate (2011). Succession planning. Learning and skills improvement service (LSIS). Retrieved on July 10, 2012 from http://www.lsis.org.uk/Services/Publications/ Documents/123121-LSIS- SuccessionPlanning2.pdf

Kahrs. J. (n.d.). Why a succession plan matters. Retrieved on July 12, 2012 from www.ProsperityPlus.com

Leimberg, S., Yohlin, J. & Rosenbloom, M. (1992). The corporate buy-sell handbook: An essential guide to business succession planning. Dearborn Trade.

Mamprin, A. (2002). Next in line: Five steps for successful succession planning. Banff Centre for Conferences, ASAE. Retrieved on October 3, 2012 from http://www.asaecenter.org/ Resources/articledetail.cfm?ItemNumber=13393

Matthews, C. (2001). Choosing a successful successor. Mansueto Ventures LLC. Retrieved on July 10, 2012 from http://www.inc.com/articles/2001/10/23550.html

Matthews, C. (2001). Planning for succession. Mansueto Ventures LLC. Retrieved on July 10, 2012 from http://www.inc.com/articles/2001/10/23547.html

McNamara, C. (2010). Succession planning: Is it a staffing matter? No. Free Management Library, Authenticity Consulting, LLC. Retrieved on July 10, 2012 from http://managementhelp.org /blogs/nonprofit-capacity-building/2010/06/17/succession- planning-is-it-a-staffing-matter-no/

McNamara, C. (n.d.). How to do succession planning. Free Management Library, Authenticity Consulting, LLC. Retrieved on June 25, 2012 from http://managementhelp.org/staffing/ succession-planning.htm

Merriam-Webster’s 11th edition of the Collegiate Dictionary

Michigan.gov (n.d.). Succession planning tool kit. Retrieved on July 10, 2012 from http://www. michigan.gov/documents/mdcs/ SuccessionPlanningCareerPipelineToolKit_213235_7.pdf

Miles, S. A. (2009). Succession planning: How to do it right. Retrieved on September 18, 2012 from http://www.forbes.com/2009/07/31/succession-planning-right-leadership- governance-ceos.html

Opm.gov (n.d.). Succession planning process (2005). Retrieved on July 10, 2012 from http://www. opm.gov/hcaaf_resource_ center/assets/Lead_tool1.pdf

Reh, F. J. (n.d.). Succession planning. Retrieved on July 10, 2012 from http://management.about. com/od/organizationaldev/a/Succession-Planning.htm

Robert, L. & Carolyn, N. (n.d.). Succession planning: Filling and developing the pipeline.

Turknett Turknett Leadership Group. Retrieved on July 10, 2012 from http://www.publicpower.org /files/Power Point/Turknett, Robert & Carolyn – Succession Planning- Filling and Developing the Pipeline.ppt

Robinson, K. E. (2012). Succession planning: How clear is your succession line of sight? Retrieved on July 19, 2012 from http://www.fedsmith.com/article/3394/succession- planning-how-clear-your-succession.html

Rothwell, W. (2005a). Effective succession planning: Ensuring leadership continuity and building talent from within (3rd ed). New York: Amacom.

Rothwell, W. J. (n.d.). Ten key steps to effective succession planning. Retrieved on July 18, 2012 from http://www.halogen software.com/files/PDF/whitepapers/Ten_KeySteps_in_ SuccessionPlanning.pdf

Rothwell, W. J. (2007). The nuts and bolts of succession planning: A Dale Carnegie® White Paper. The Pennsylvania State University, University Park, PA.

Rothwell, W., Jackson, R., Knight, S., Lindholm, J., Wang, A., & Payne, T. (2005b). Career planning and succession management: Developing your organisation’s talent—for today and tomorrow. Westport, CT: Greenwood Press/an imprint of Praeger.

Schaefer, K. (2002). Planning executive leadership. Retrieved on July 10, 2012 from http://www. usfa.fema.gov/pdf/efop/efo13091.pdf

Stensgaard, A. (2007). Why is succession planning important? AME Info FZ LLC. Retrieved on July 10, 2012 from http://www.ameinfo.com/59276.html

Stuart, S. (n.d.). A Spencer Stuart round table discussion. Retrieved on July 23, 2012 from http://content. spencerstuart.com/sswebsite pdf/lib/succession_RGB.PDF

SuccessFactors, Inc. (2008). Taking care of your company’s future: 3 best practices for succession planning. Enterprise Insight Series.

Webster’s Online Dictionary – Definition: dictionary. Retrieved on August 5, 2012 from www.websters-online-dictionary.org. http://www.webcitation.org/5sM3Z7U4T. Retrieved 2010-08-29.